Development Zones

5% Income Tax on Manufacturing Activities

0% Income Tax on Exported Services

Jordan's Development Zones: Investment Benefits & Incentives

The ministry regulates the work of development zones throughout the Kingdom. They are dedicated to various fields of business and industry and are equipped with the investor’s needs of infrastructure and services. These areas are managed by development companies that work to develop the infrastructure and facilitate the work of investors. Development zones aim to distribute the gains from economic development and create job opportunities by creating a competitive advantage based on specialization and providing an integrated system of services to investors that support the growth and development of enterprises.

Benefits and Incentives for Registered Enterprises in Development Zones

100% Exemption for Buildings and Constructions

Paving, organization and improvement, licensing fees, and building & land taxes.

0% Customs Duties & Sales Tax

This exemption applies to fixed assets. inputs. production requirements, a spare parts within development zones.

10% Income Tax

This rate applies to all other registered enterprises operating within development zones.

5% Income Tax

One of the lowest in the region, available to manufacturing companies operating in development zones.

0% Sales Tax on Exported Services

Exported services are completely exempt from sales tax, offering additional savings for service-based sectors.

Local Market Exemptions for Jordan-Origin Goods

Goods produced within the Development Zone that qualify as Jordanian origin are exempt from all customs duties and taxes when sold locally.

0% Income Tax on Exported Services

Companies exporting services enjoy full income tax exemption, boosting competitiveness in international markets

Sales Tax Exemption on Handling and Transport Vehicles

Handling and transportation vehicles (10+ persons including driver), sold to a Registered Establishment for transporting workers, are exempt from general sales tax.

Income tax on the institutions registered in developmental zones

The tax on the enterprise registered in the developmental zones arising from the activities of the licensed manufacturing industries in these zones where the local added value is not less than (30%) is at the rate of (5%).

Income tax shall be at a rate of (10%) of the taxable income of the registered enterprises in the development zone for the rest of its activities and projects.

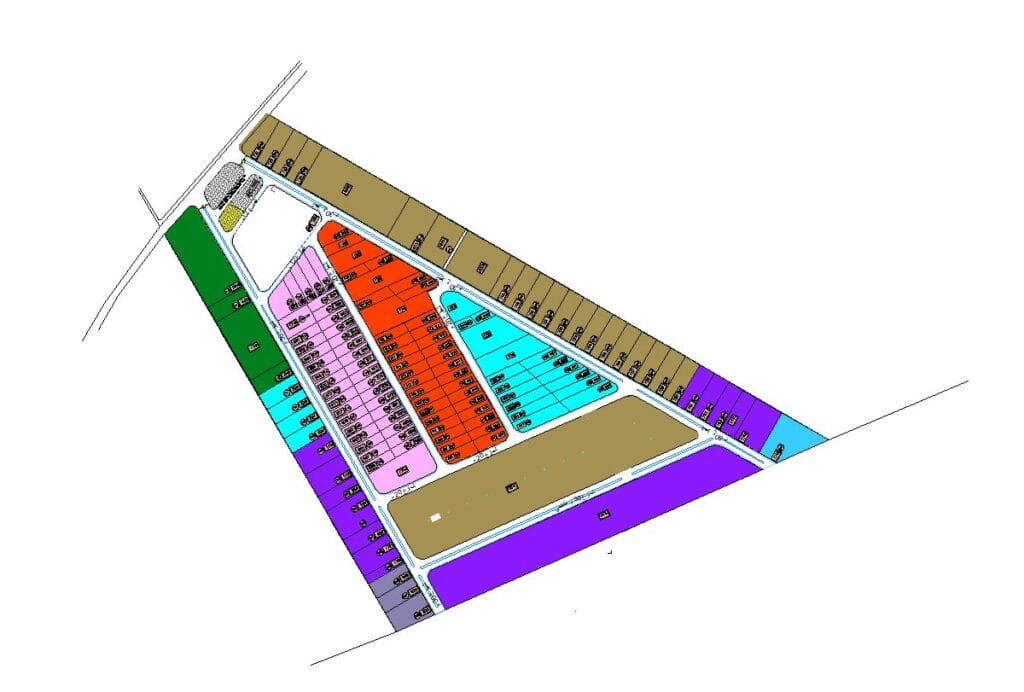

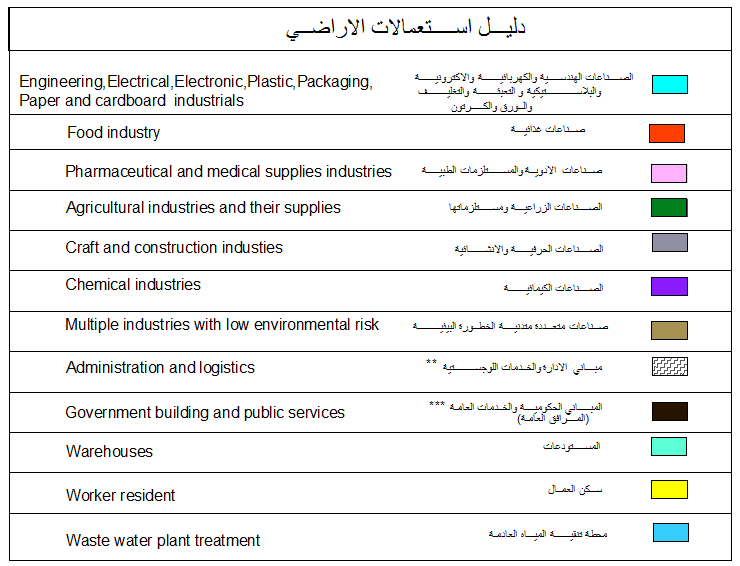

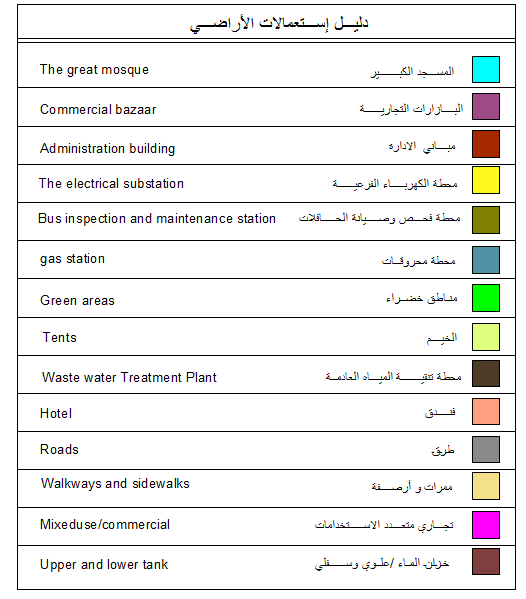

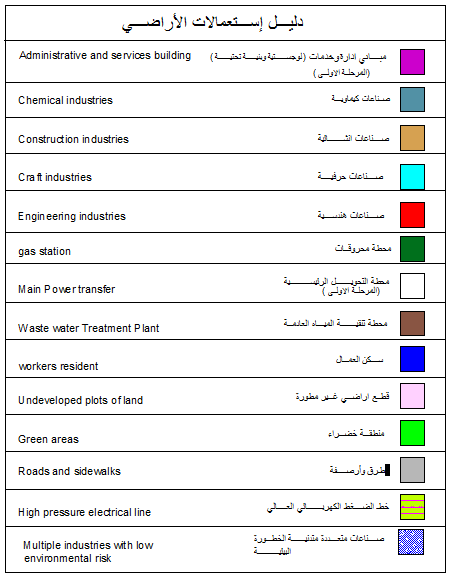

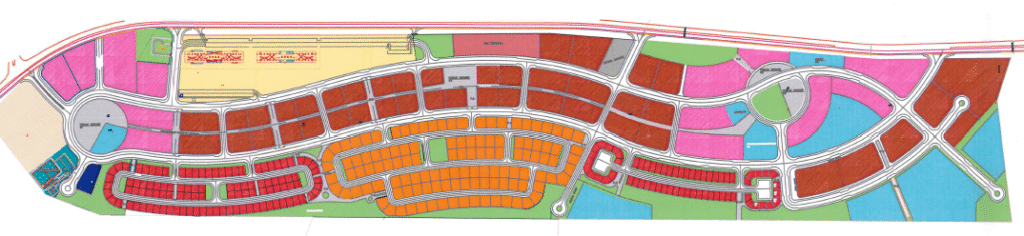

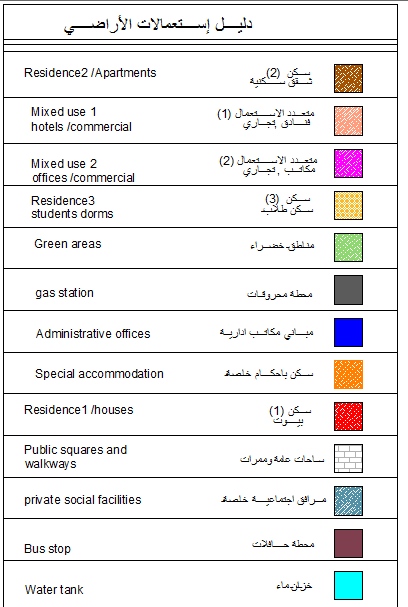

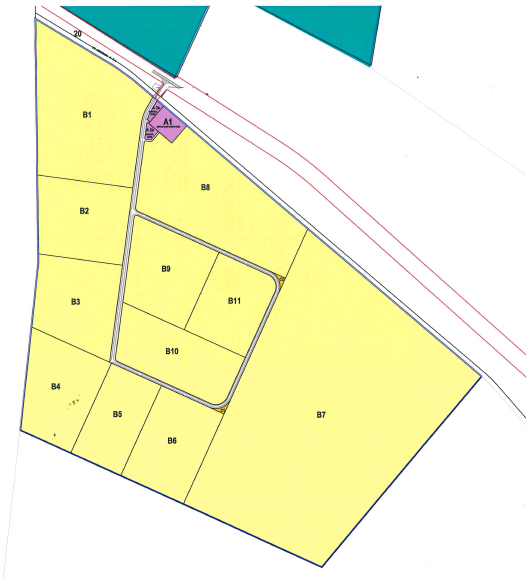

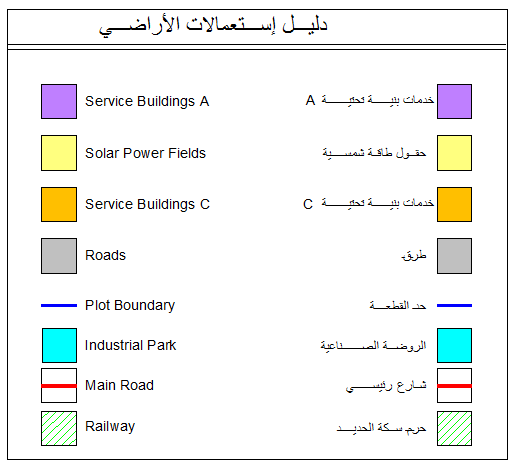

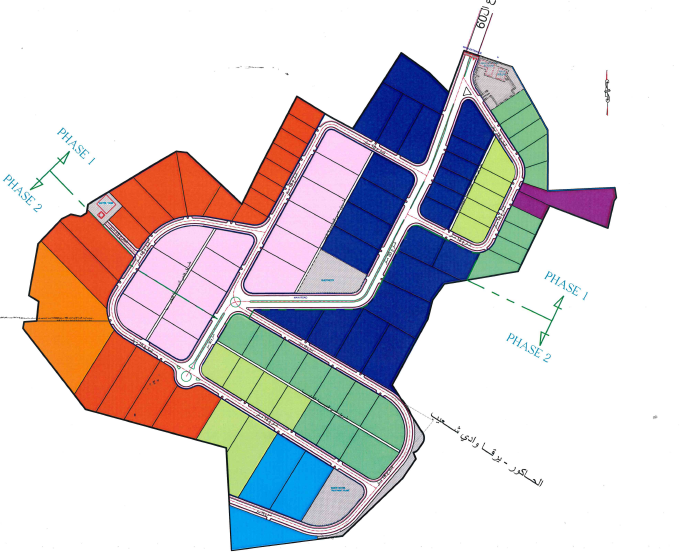

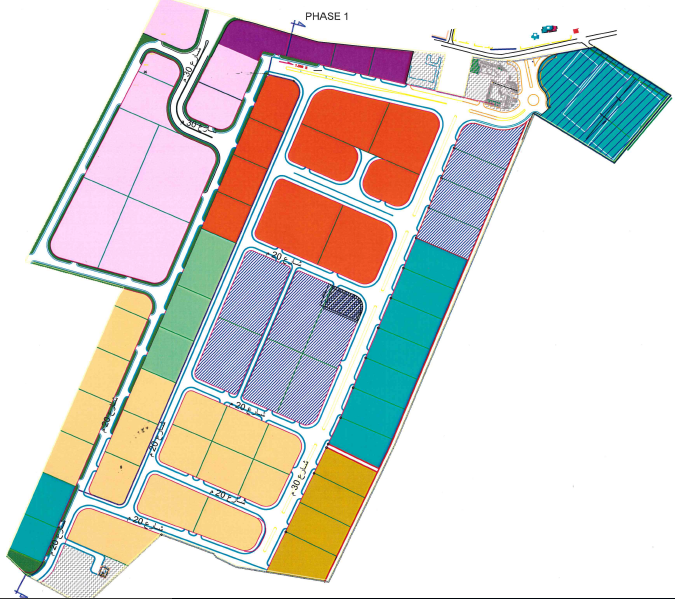

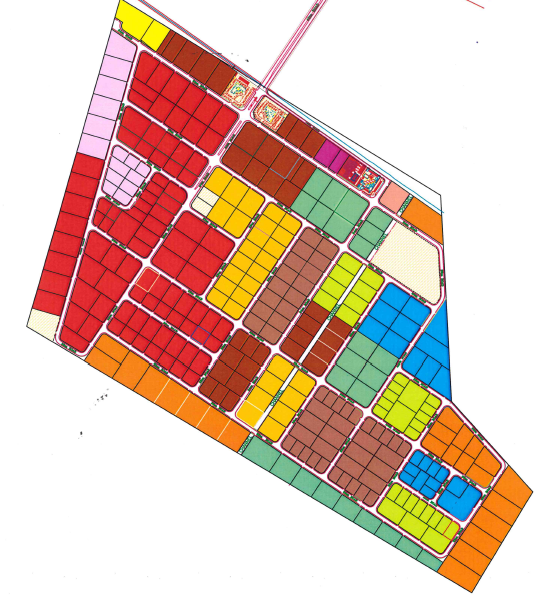

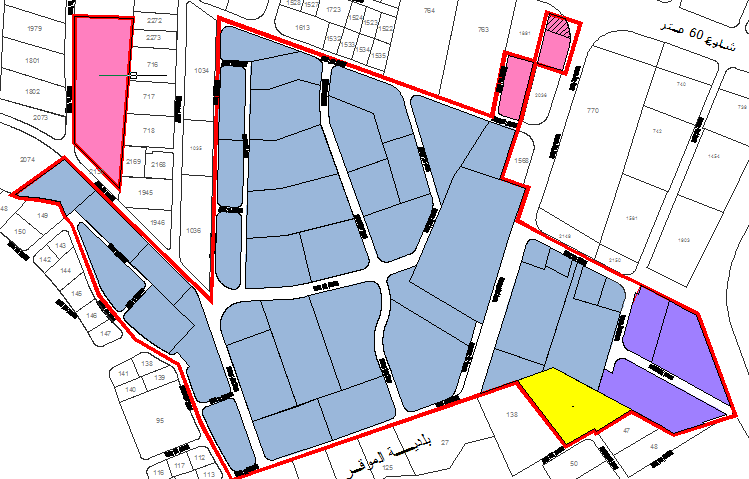

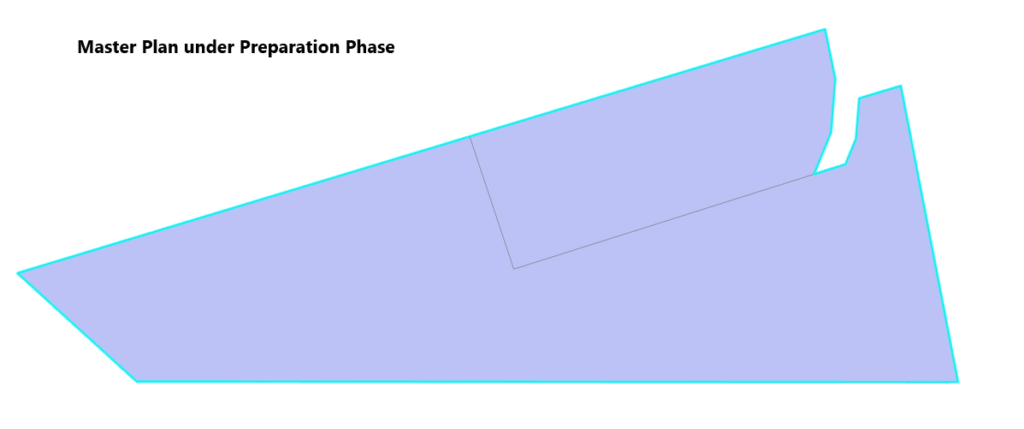

Master Developer

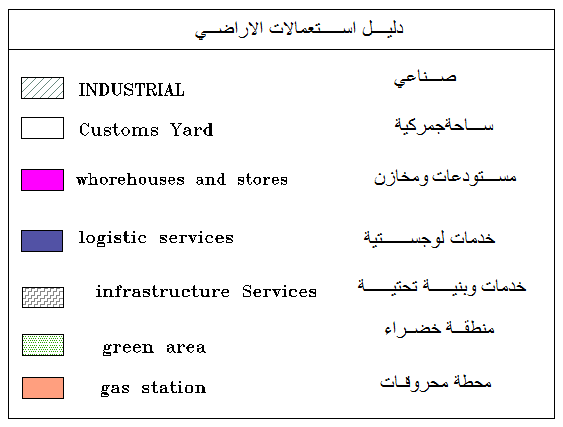

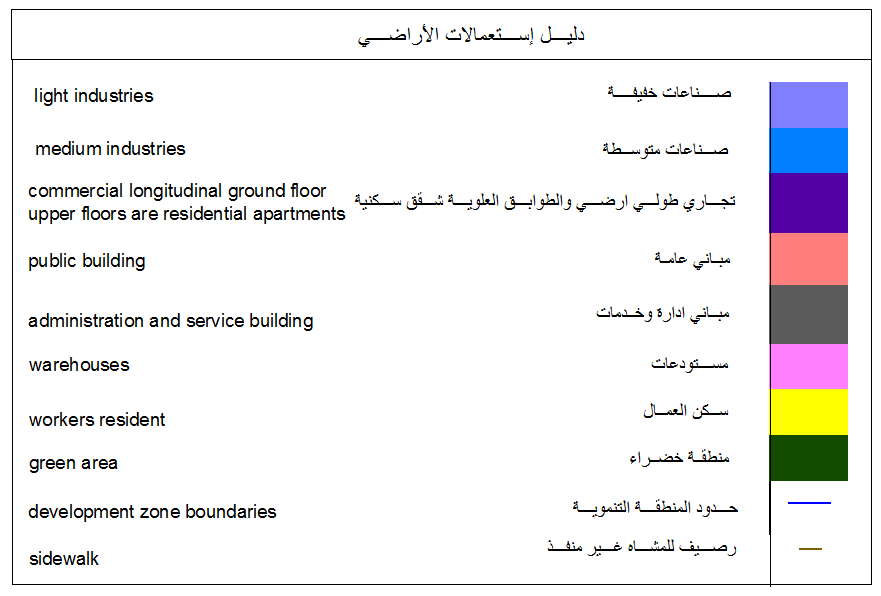

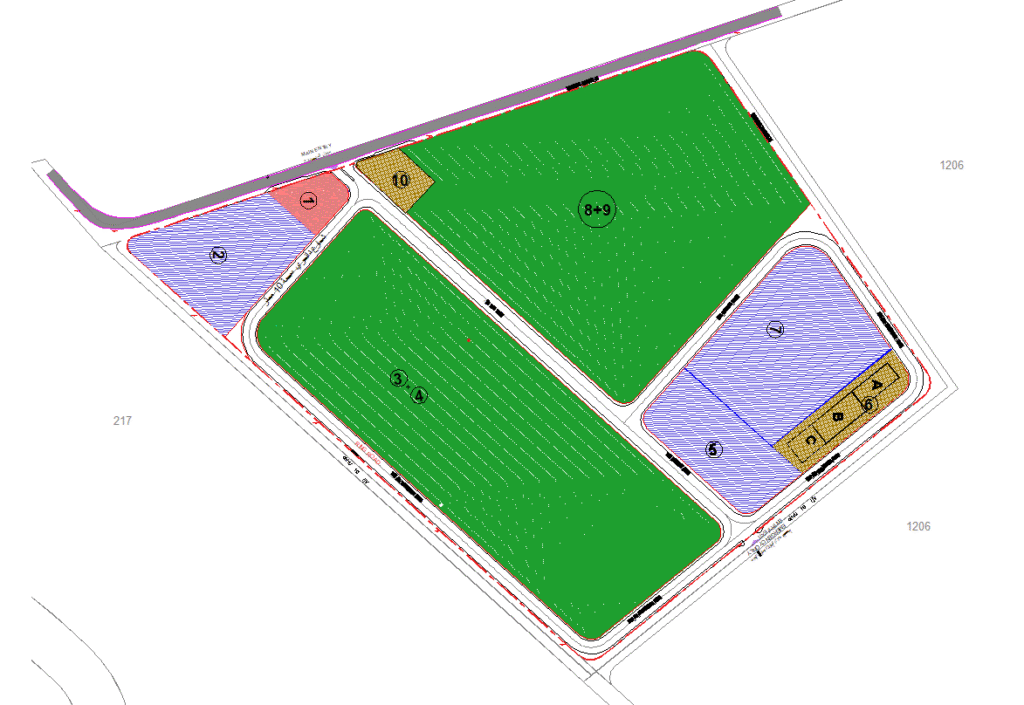

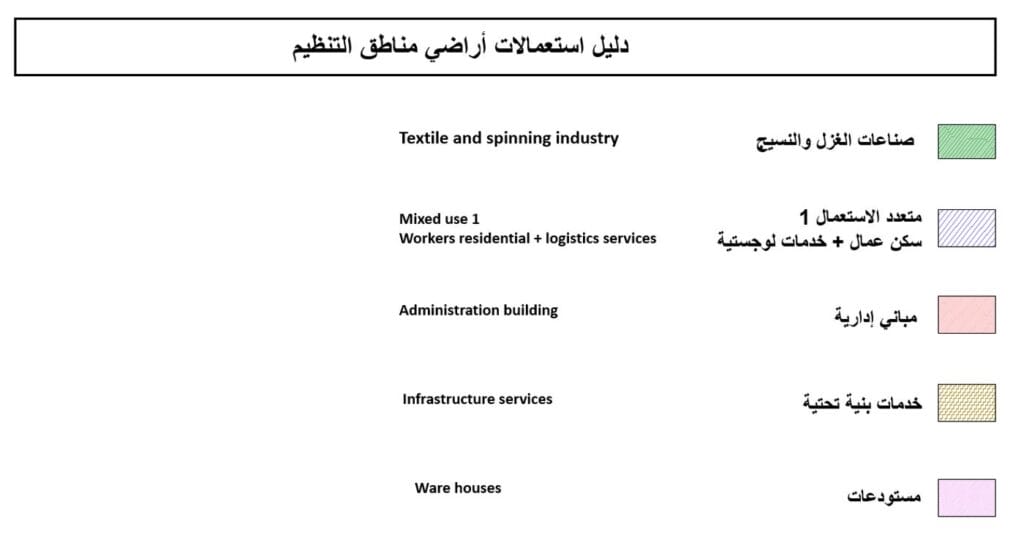

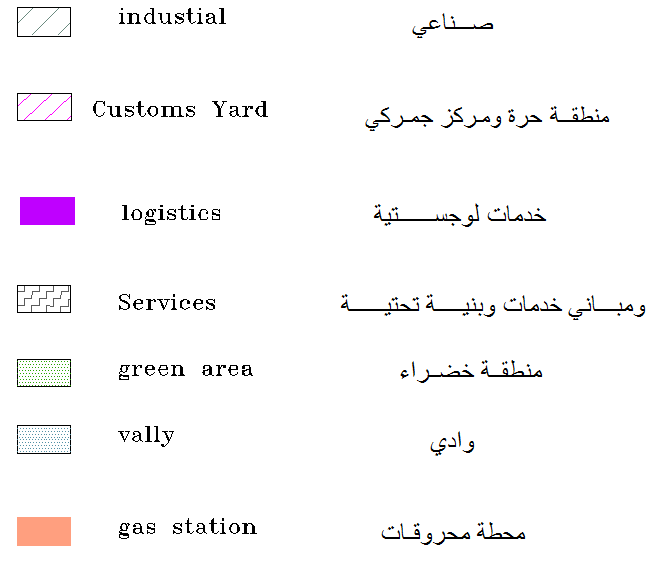

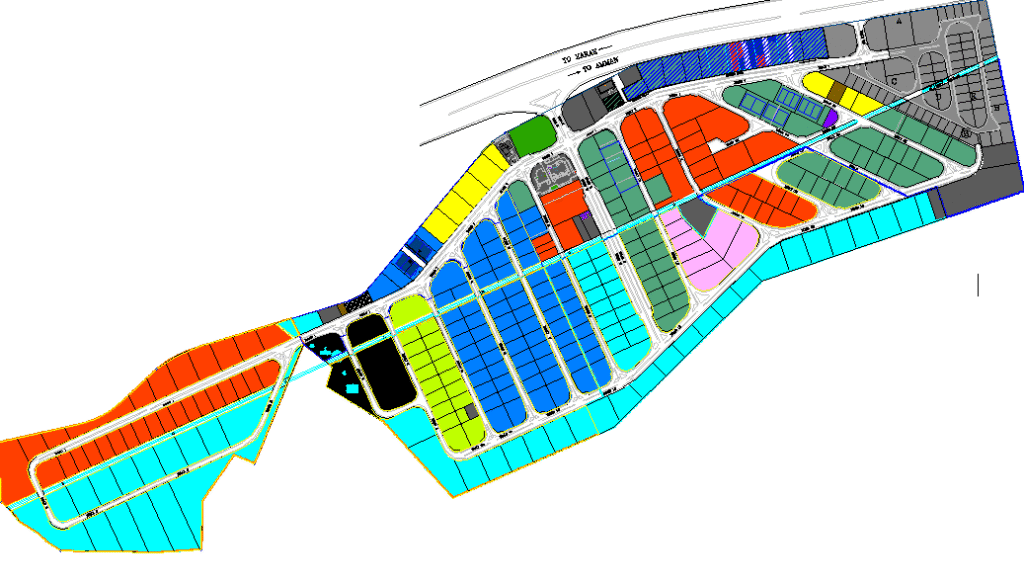

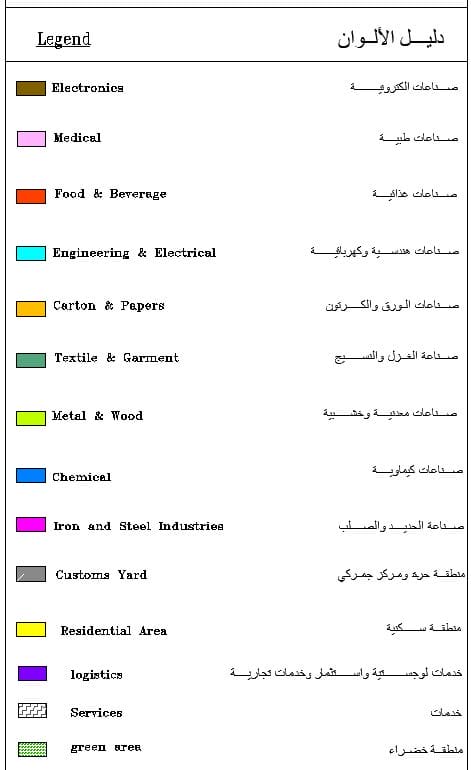

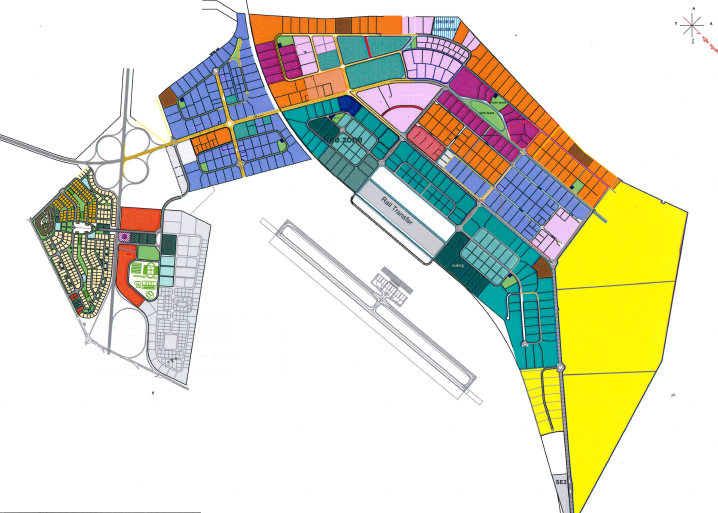

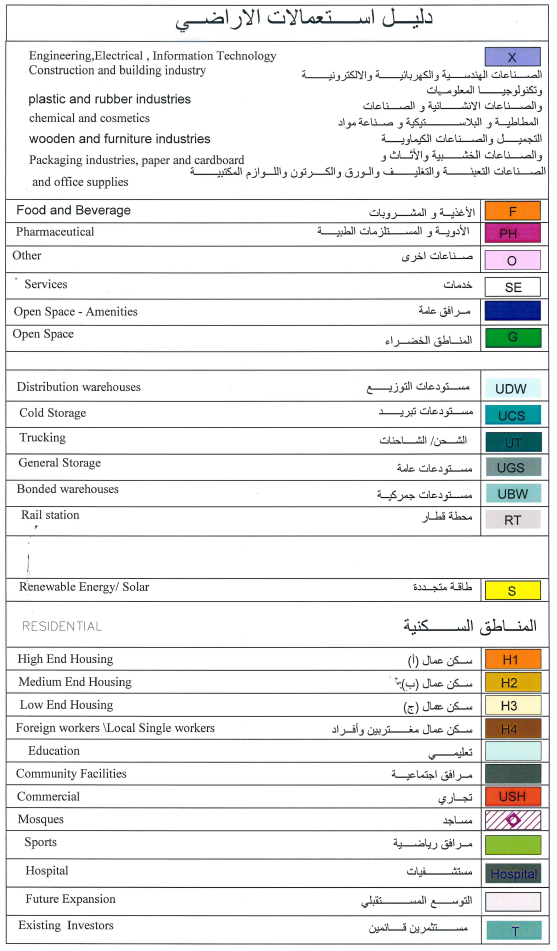

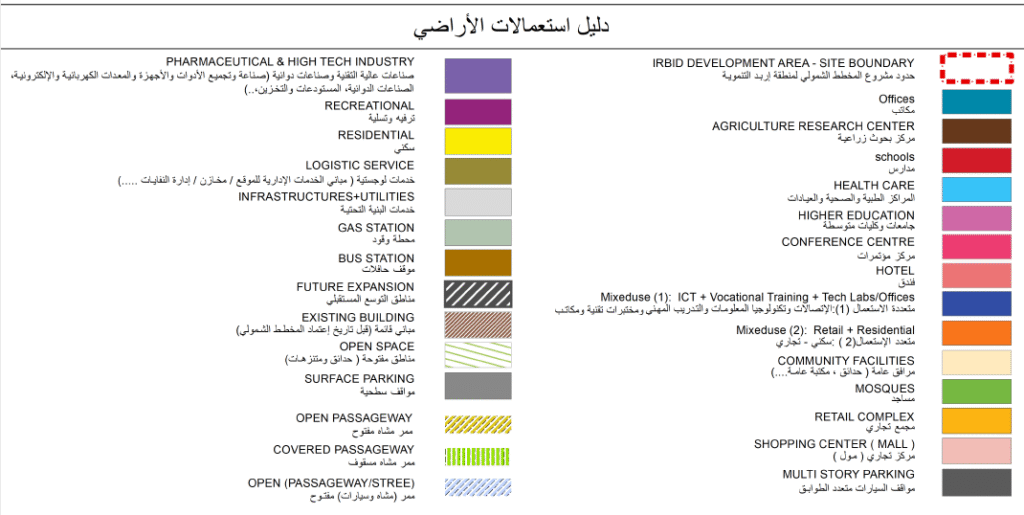

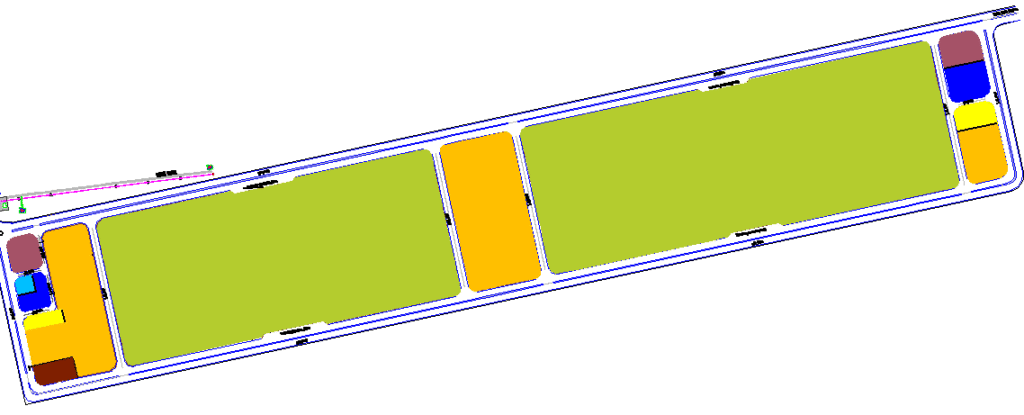

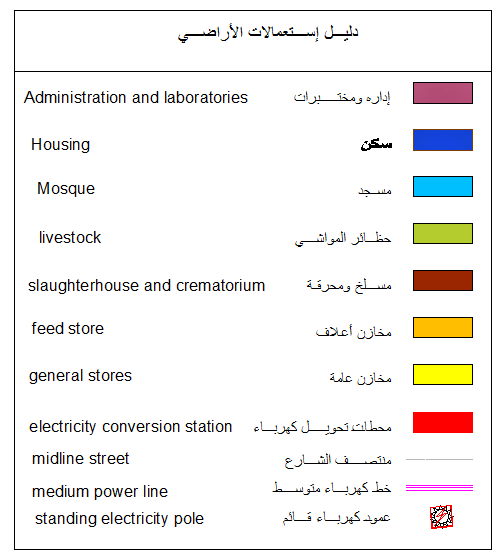

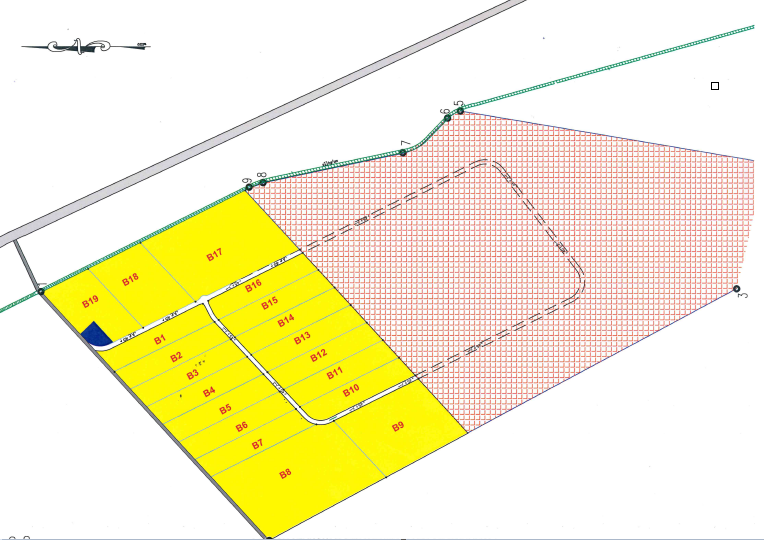

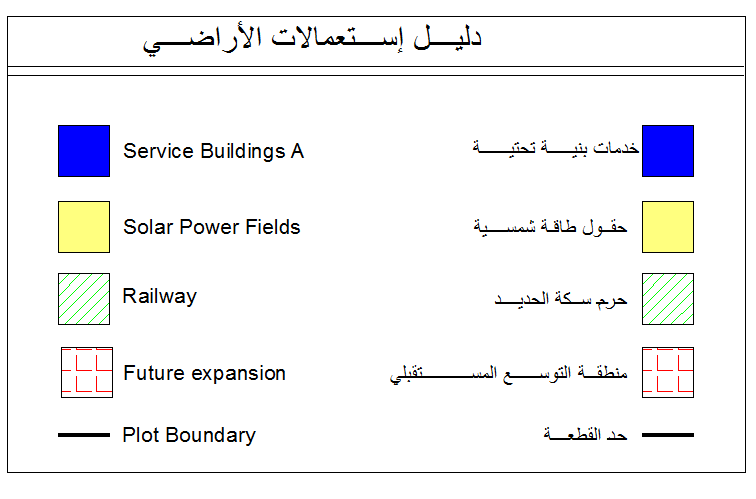

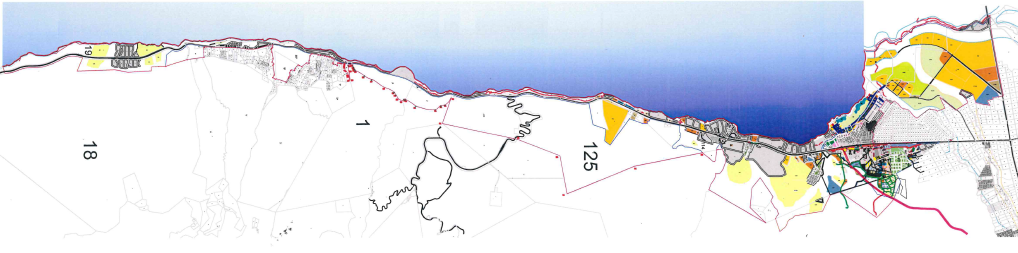

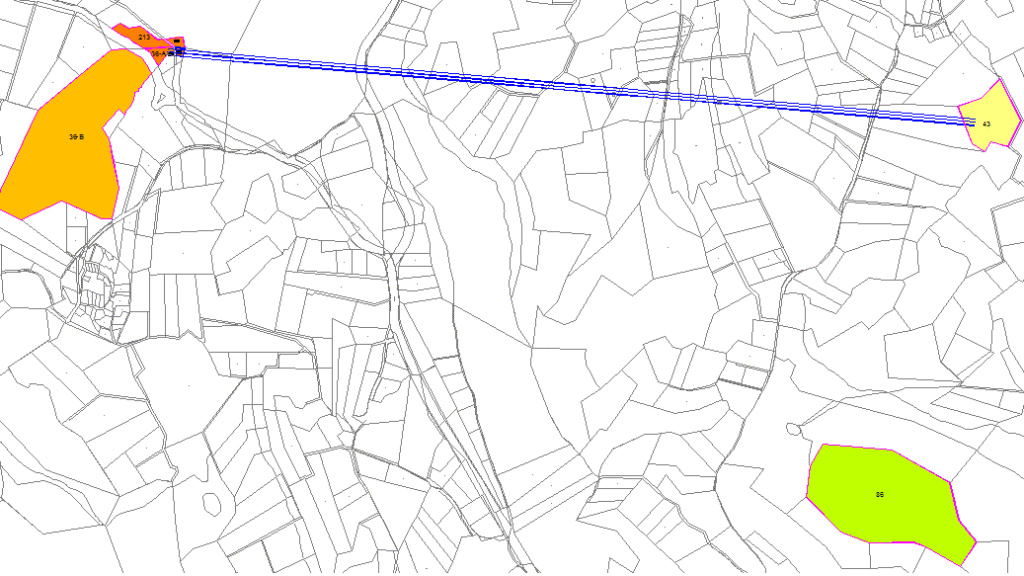

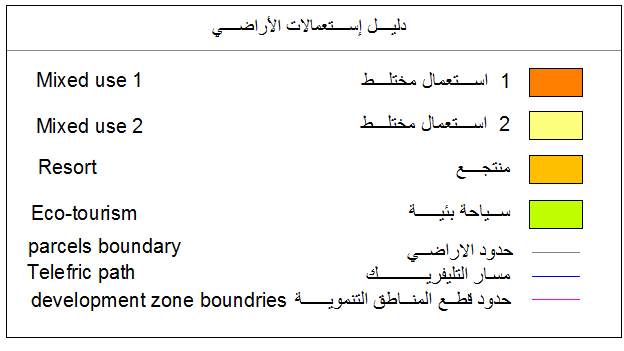

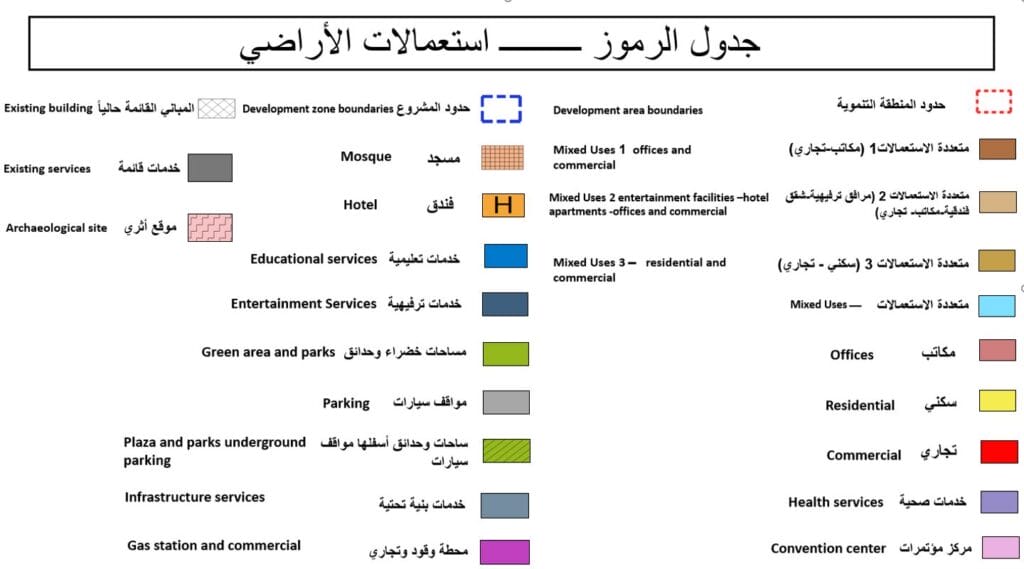

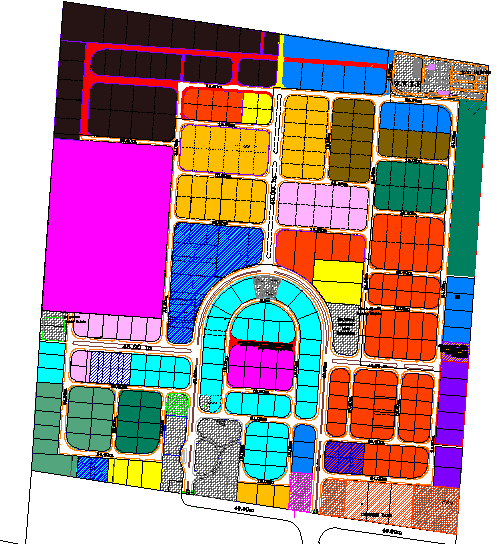

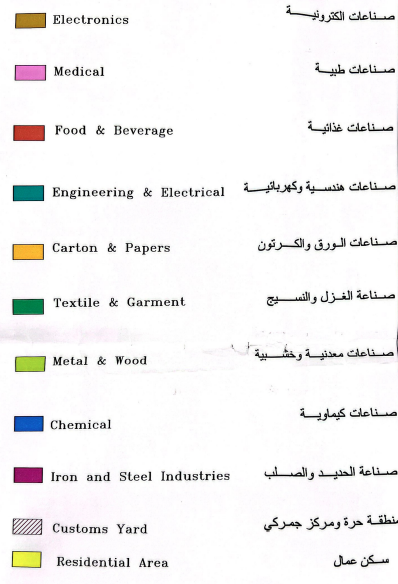

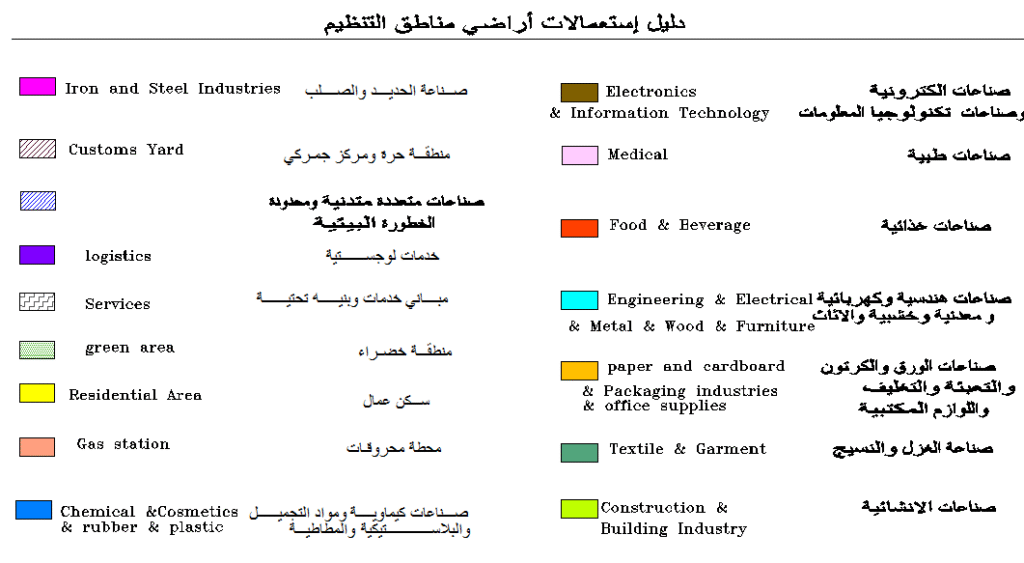

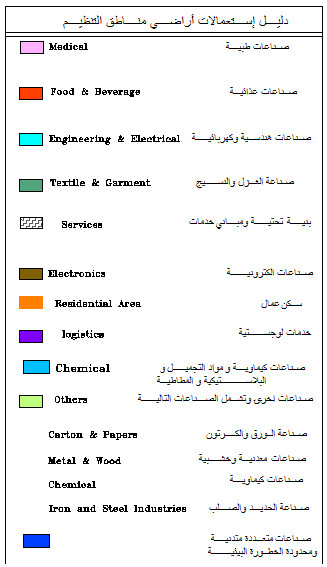

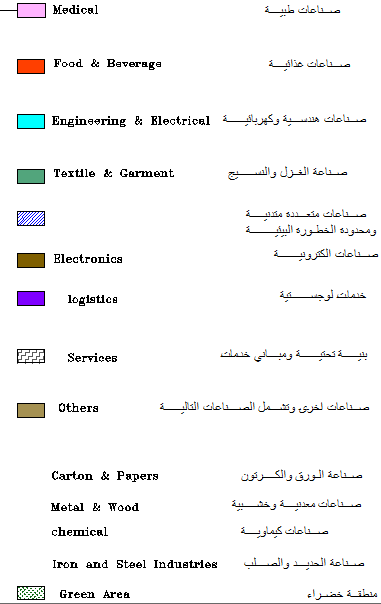

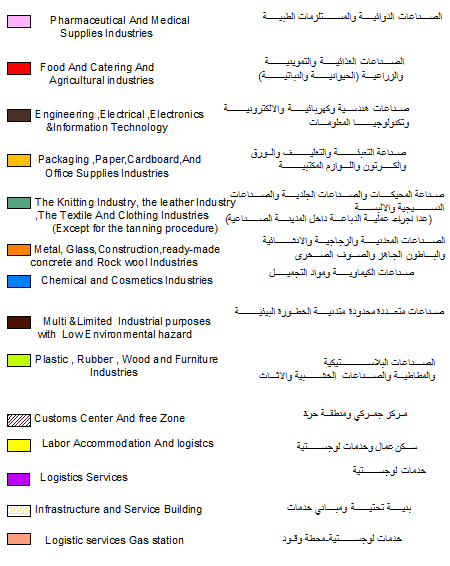

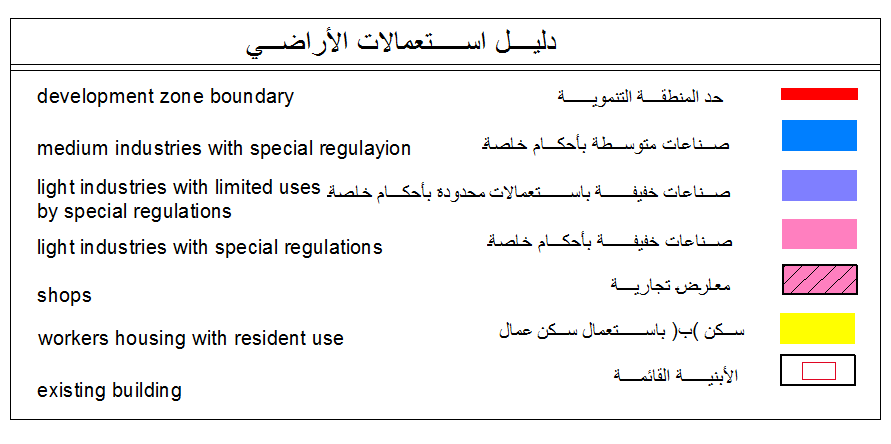

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Land Use Guide

Master Developer

Master Developer

Land Use Guide

Master Developer

Economic Activity Licensing in Development Zones

The Ministry of Investment is responsible for issuing electronic licenses for conducting economic activities within development zones. This license serves as an official and accredited professional permit.

As the regulatory authority, the Ministry also issues construction permits for establishments to ensure an investment environment that aligns with regulatory provisions and comprehensive master plans, while meeting structural and public safety requirements. This ensures the highest levels of efficiency and effectiveness in service delivery.

To access the Ministry of Investment’s electronic services portal, click here:

https://portal.moin.gov.jo/Investment/LoginPage